Rhode Island Housing Market Trends: A Data-Driven Look at Cranston, Cumberland, Smithfield, Lincoln & Beyond

Rhode Island Housing Market Trends: A Data-Driven Look at Cranston, Cumberland, Smithfield, Lincoln & Beyond

If you’ve been asking “Is now a good time to buy or sell real estate in Rhode Island?”, you’re not alone. It’s one of the most common questions I hear from homeowners, buyers, and investors across Northern and Central Rhode Island.

Instead of opinions, headlines, or fear-based predictions, let’s look at real data — and what it tells us about the housing market in:

- Cranston

- Cumberland

- Smithfield

- Lincoln

- Warwick

- Coventry

- North Providence

- Johnston

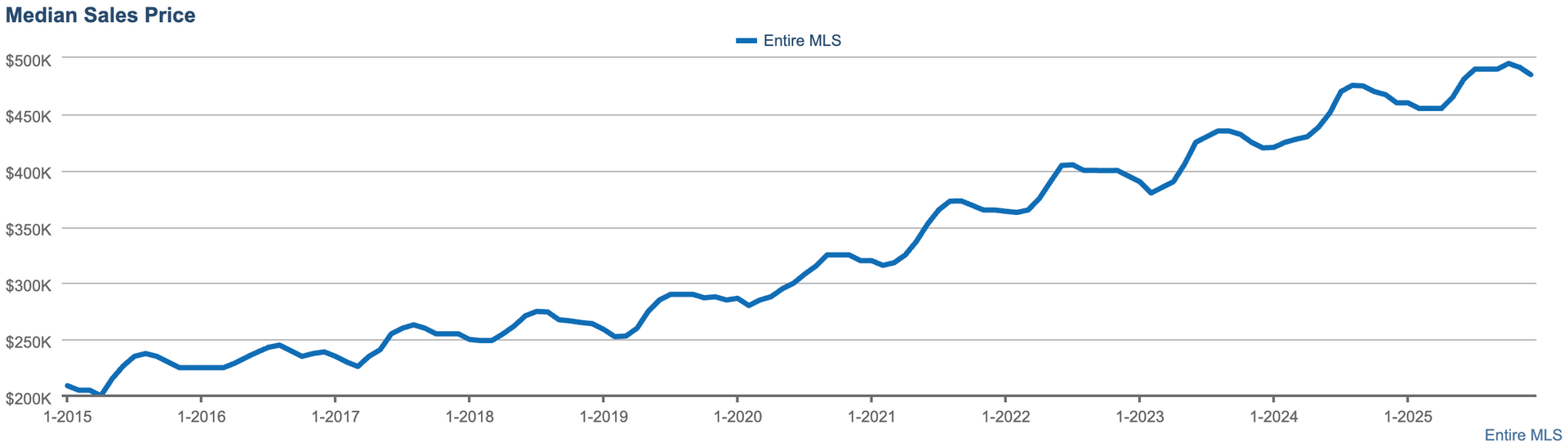

10 Years of Rhode Island Home Prices: What the Data Shows

Over the last decade, Rhode Island home values have followed a

clear, consistent trend:

they move upward over time.

Yes — there are moments where the market flattens.

Yes — there are seasonal slowdowns.

But zoom out far enough, and the direction becomes obvious.

The housing market doesn’t move like an elevator

It moves like a staircase.

There are pauses.

There are landings.

But over 10 years, each step builds on the last.

This is exactly what we see when analyzing long-term price trends across Rhode Island communities

Untitled document (29) (1) (1)

.

“Realtors Always Say Buy Now” — Here’s the Honest Truth

This is a fair criticism — and one I hear often.

But here’s the reality:

Waiting for the “perfect time” to buy real estate is like waiting for gas prices to return to what they were five years ago.

They might dip temporarily.

But historically, they don’t move backward long-term.

The same applies to housing.

The data shows that:

- Yesterday was usually cheaper than today

- Today is often cheaper than tomorrow

- Time in the market beats trying to time the market

This isn’t hype — it’s math.

What This Means for Buyers in Rhode Island

If you’re buying in places like Cumberland, Smithfield, Lincoln, or Coventry, waiting too long can quietly cost you more than people realize.

Even small increases in home prices can mean:

- Higher monthly payments

- Larger down payments

- Tougher competition

- Fewer options

Interest rates change. Markets cool and heat up.

But

long-term ownership has historically rewarded patience, not hesitation.

What This Means for Sellers in Cranston, Warwick & Johnston

If you’re a homeowner thinking about selling, especially in Cranston, Warwick, Johnston, or North Providence, understanding market timing vs market positioning is key.

Pricing, condition, demand, and local inventory matter far more than guessing the exact “top.”

Data-driven sellers win because they:

- Price correctly from day one

- Understand buyer behavior

- Leverage current demand instead of reacting to headlines

Why Local Market Knowledge Matters More Than National Headlines

Rhode Island is not a single market — it’s a collection of hyper-local micro-markets.

What happens in

Cranston doesn’t always mirror

Smithfield.

What works in

Warwick may not apply to

Cumberland.

That’s why real expertise means:

- Studying neighborhood-level data

- Tracking inventory, absorption rates, and price trends

- Understanding buyer psychology locally — not nationally

Final Thought: Numbers Don’t Lie

The biggest takeaway from a decade of Rhode Island housing data is simple:

Real estate rewards those who play the long game.

If you’re buying, selling, investing, or just trying to understand your options — a personalized strategy based on real numbers always beats guessing.

If you want help deciding what makes sense for your situation, reach out anytime.

Data is powerful — but only when it’s applied correctly